We will extend in this post over the discussion we had in the previous one. In which the payments is not only done within the boundaries of the banks but delegated to separate entities and third parties other than the acquiring and issuing banks.

Acquirer Processors

Mission of the acquirer processor is to manage and maintain the payment starting from the terminal to the card network. This means it will provide the connectivity to the card network using the Card Network Interface, and in many cases they provide the terminal devices to the merchants as well. A lot of other operations can be done by the processor like settlement, risk management..etc.

More or less, the acquirer processor is the technical infrastructure for the payment to be sent to the card network, and to the issuer afterwards.

On the other hand, the acquirer bank holds the liability and acts as the legal member entity in the card network. Acquirer banks are not always part of the technical payment transaction flow, as we can see in the diagram below, but they are responsible for the settlements between the network and the merchant accounts. They communicate with every financial institution to retrieve funds and ensure that the merchants get the total sum of their customers’ purchases.

Issuer Processors

Same as acquirer processors, issuer processors are more the technical infrastructure and connectivity provider to receive payments for the issuer bank, and thus for the end customer (card holder). They cover as well other aspects like activation and blocking of cards, issuing and reissuing, and PIN management.

The issuer bank or the issuer, has the card holder bank account and is the BIN sponsor, whose logo is on the card. Usually the card holder is a customer for the issuer bank and has an account in this bank. As in the case of the acquirer, the issuer bank is the one who is liable in front of the card network, and on behalf of the card holder.

Liability and risk in card payments is a quite long and critical topic, and how it is shifted between the merchant, acquirer, card network, issuer, and card holder based on the different situations.

Payment Facilitators or Aggregators

Payment facilitators or (PayFac) provide a layer of abstraction and convenience for the merchants, on top of the acquirer processor and bank. Since onboarding merchants to an acquirer bank can be a lengthy process, a payment facilitator already has an agreement and relationship established with an acquirer bank, and can onboard merchants quickly and easily. Usually facilitators or aggregators target small and medium businesses.

In case the merchant is using a facilitator or aggregator, they will be given a sub merchant account at the facilitator. Which means these accounts ledger are maintained at the facilitator, while the facilitator acts as a merchant for the acquirer. The facilitators settles with the acquirer for all the merchants they manage, and then settle with each merchant separately.

You can see that a merchant doesn’t have a direct agreement with an acquirer bank but with a facilitator when you see its transaction in your bank statement starts with the facilitator name. For example CCV merchant name, where CCV is the facilitator name.

Most facilitators provide a payment gateway which is the online gateway for payments in e-commerce. As in the case of the brick and mortar store, the online merchant has to have an agreement with a payment gateway, in order to process payments online besides the regular terminal in the physical store. Both are provided by the same facilitator in many cases.

Sometimes facilitators aren’t acquirer processors, which means they don’t have a direct connection to the card network. So they have to have an agreement with an acquirer processor. Other aggregators can act as both. For facilitators only players, acquirers act for them as their entry point to the banking system, by which they can transfer their payouts to the merchants.

Examples

In US for example, FirstData (or Fiserv), TSYS, Chase Paymentech are acquirer processors.

Square is an aggregator and an acquirer processor but not an acquirer, while Chase Paymentech is Square’s acquirer and processor.

Stripe is a facilitator and acquirer processor but they use WellsFargo, NCP, and Cross River banks as their acquirer.

On the other hand, Adyen acts in Netherlands as an aggregator, and as an acquirer processor, and as an acquirer. Merchants can have Adyen account but these accounts are limited to the collection of merchants payouts and shall always be “sweeped”, which means to transferr all the money in these accounts to merchants’ regular third party bank accounts.

A facilitator like Buckaroo in Netherlands is not an acquirer nor a processor for Visa for example, which means they don’t have connectivity to Visa network. While Silverflow, CCV are major acquirer processors besides Adyen.

Some facilitators have different acquirers in multiple countries, while others can have all of them in one country. Indeed, this will make the payouts to merchants a bit more slower as we will discuss in upcoming posts.

You can see a list of acquirers in this page for Mastercard. In Visa Global Registry of Service Providers, you can search for all visa partners with all types in all countries.

For example, in Egypt, there are 6 VisaNet acquirer processsors who are connected to the visa network: E-fiannce, National Bank of Egypt, Qatar National Bank, and others. These are used by other well known facilitators like Fawry and Aman.

Almost all banks who are acquirers act as issuer processors, since they already have the connectivity to the card network. Other vendors act only as issuer porcessors like Marqeta and Galileo.

Payment Flow with Processors

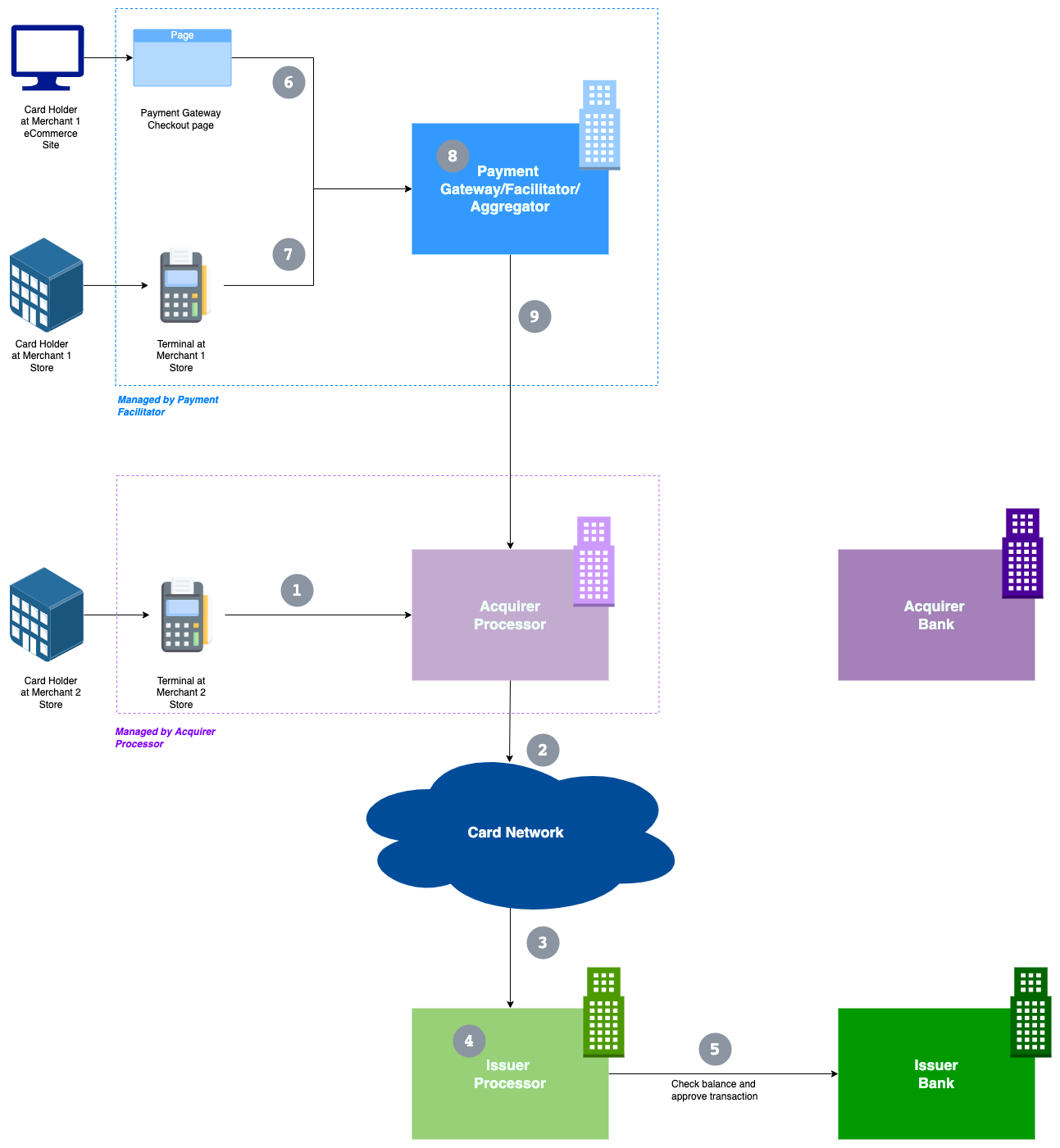

- First we start with a card holder using his card on a terminal at a merchant who has agreement directly with an acquirer/processor. The transaction is sent directly to the acquirer processor system.

- The processor checks the BIN to identify the card network, and through the relevant card network interface, transaction is forwarded to the card network.

- The network checks the BIN, looks up which issuer processor manages transaction for the issuer bank who sponsors the BIN, then forwards the transaction to the issuer processor.

- If it is a credit, charge, or prepaid card, usually the ledger of these card accounts are maintained at the processor, and thus issuer processor approves the transaction without getting back to the issuer bank.

- If it is a debit card, the balances of the bank account has to be checked, and thus the issuer processor has to communicate with the issuer bank to approve the transaction. The integration here is specified by the issuer processor and implemented and provided by the issuer bank to the issuer processor.

- Another path with a smaller merchant, who has his own e-commerce site besides the physical store, and has an agereement with a payment facilitator. The merchant uses the facilitator’s checkout page and plugins in his site for payment. The checkout page/plugin is managed and maintained by the facilitator. The merchant doesn’t have any visibility on card or customer data used in the payment.

- The merchant uses the terminal provided by the payment facilitator in his physical store. Both transactions, Card Not Present (online) and the terminal transaction in the previous step go to the systems of the payment facilitator.

- The payment facilitator maintains a ledger or balances of the submerchants accounts.

- The transaction is forwarded to the acquirer processor who has an agreement with the facilitator and continues as usual till the issuer processor and bank.

In next articles, we will get more technical and talk about the integration points between all these parties.

A quite useful series in this topic is the one created by Ahmed Siddiqui, "Payments Ecosystem Overview". His book "Anatomy of the Swipe" is quite useful in this topic as well.